10 Ideas For The Way To Invest Buck5,000 In Actual Home Nowadays

Rei may perhaps seem like desire tied to the extra-prosperous, but now you may spend money on real estate property. Buying real estate investment is for those people chasing wealth, but in addition someone who wishes fiscal steadiness or even to start retirement planning. According to numerous reviews, possibly 90Percentage of the rich became abundant, not less than partly, due to real-estate opportunities. And modern-day people keep that real-estate is a strong investment.

When real estate investment as an investment is comparatively stable, it's actually worth noting its weak points also. Most shareholders agree that housing is ideally suited for to be a long-name investment decision. Every single real estate professional will show you, it can be hard to calculate when real estate could possibly sell, making it tricky to sell assets at short recognize.

Conversely, other deficiencies have been over-stated. You don’t necessarily want lots of money to advance real-estate. If you’ve got Buck5,000 in the bank, you have more than sufficient to begin with. These are generally 10 methods make investments Buck5,000 in solid property at the moment.

just one. A payment in advance for your house

Should you haven’t previously obtained a property, among the best property opportunities is usually to private your own property. Most folks key goal with investing in a home is to access shelter and help you save hire funds - and in case you could be planning on staying in your home for longer than 5yrs and you also get wisely, it is best to make back what you’ve spent to get - but for the way you strategy home ownership, it may also be well worth the cost.

The main element to presenting your home as a possible financial commitment property besides housing is earning equity. To make this happen, you'll also want to actually pay it back in many years or less. If you intend your makeovers and improvements effectively, contain further importance home.

Most people imagine they need to hesitate on getting a house until finally they have 20Per cent straight down, but down payments arrive in several sizes. Some mortgage loan possibilities need not as much than 20Per-cent, or no deposit in the least.

These house loan types accompany other limitations for instance, Home loans mortgage loans are normally restricted to initial-time potential buyers. Conversing with an area real estate professional is an alternative way to uncover what loan types chances are you'll be eligible for and the ways to get the Dollar5,000 to be effective as a payment in advance.

2. Book to possess

If you'd like to get hold of a residence but are dealing with hurdles like poor credit or higher credit debt, then rent-to-very own alternatives may possibly meet your needs exactly. There are lots of various kinds of let-to-personal legal papers, and you ought to know a lttle bit about each and every.

The bare bones of it is the fact in many legal papers you may be lawfully forced to acquire your house following the book (a lease invest in settlement). Other people offers you the alternative, but no duty (a rent option contract).

Book-to-individual deals normally require an transparent repayment, and then they work about like letting. The use of your Buck5,000 to finance your advance repayment for the book-to-own home, at the end of the local rental interval, any element of that Bucks5,000 can be become something like a partially down payment. You will discover certainly scenarios where by hire-to-own properties include some fairly large grabs. But there’s not any denying they have been lots for a lot of prospective buyers.

3. A partial put in with a rental property

Shopping for and looking after procurment houses is one of the major techniques to invest in property. This is especially valid if you want prolonged-time period, minimal-chance opportunities. There are too much to take into account with the purchase of the initial accommodation, especially when you happen to be interested in getting a person's landlord, but this is simple to grasp the upsides.

Financial commitment dwellings ordinarily involve not less than a 20Per cent pay in, so Money5,000 does not reach very far, though if you have a few associates who have got Bucks5,000 to bring about toward a down payment on a hire home, then the information growing a number of the threat, also. (Bear in mind to formalize any fiscal deals having a lawful deal!)

Having a paid for-off of rental is a sensible way to make second income coming in from month to month. Josh McGrath, a high real estate agent in Charleston, Western Va, is familiar with how wonderful a trade ability accommodations can be. McGrath possesses one hundred and fifty hire homes helping other people spend money on them. Although choosing a real estate control corporation might cost about 10Pct of one's revenue, McGrath advises it very.

McGrath also advocates paying for local rental attributes for a 10-12 months property finance loan period when you can. “As extensive because per month let includes my payment, income taxes, and insurance plan, in several years, it will be repaying me Money1,000 monthly and I’ll probably convey more than Usd150,000 in equity.” With earnings like this, it is easy to see how rental fees could become the perfect retirement system.

4. Book your extra room

Should you have another sleeping quarters or perhaps a basements that does not get a great deal use, then renting out your extra room is a sensible way to make investments. You could make Usd5,000 greatly assist concerning refurbishments. Finish a cellar into an in-legislations fit could add local rental importance now, but also can also much more importance if you opt to offer your own home in the foreseeable future.

Brief-period rental fees (renting a room to those on a daily groundwork) often have the potential to create the biggest four week period-to-30 days results. There are many of blog just for this, like Airbnb and VRBO, which make it simple to begin to get renter's.

five. Roof stock

Roofstock is now a great deal of coverage as a excellent “starting” investor. In place of starting your rental property from the beginning, Roofstock provides leases that are rental. Because of this from day one, you have now property owners in your house!

Additionally you already know that it’s real estate that property owners like. Some rental property components are hard to take into account, but possessing captivated more then one number of occupants in the room usually takes a little of the guess work out.

If you'd prefer thinking about lease as being a a second income but won't be adore with as a property, then Roofstock also provides you with choosing finding cash for a building manager.

6. Wholesaling

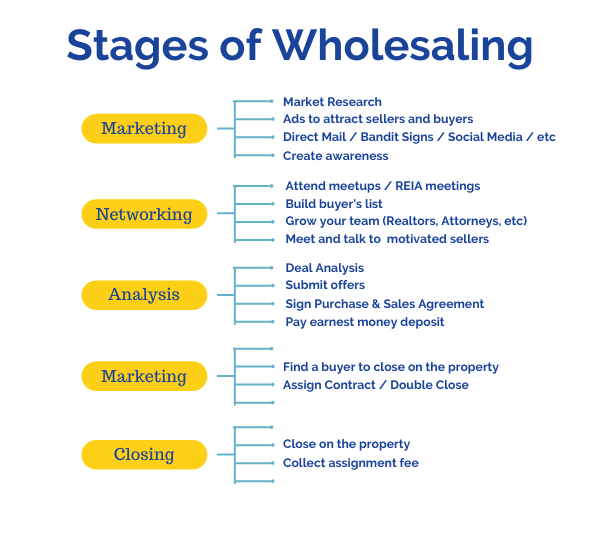

When you're not afraid of the hustle, then wholesaling is the best way to purchase real estate investment. Nevertheless the word “wholesale” could make you imagine volume acquiring, it is really not what you are doing with components.

As being a wholesaler / retailer might be a like becoming a house flipper - just devoid of the actual wholesaling part. If you have something special for viewing the wide ranging in components but shouldn’t be reliable having a chain saw, then wholesaling can be your getting in touch with.

Merchants plan houses which have been good deal-costed and then get a last customer for the kids. Being a matchmaker, figuring out many men and women and becoming a fantastic speaker is essential listed here. Any buyer who is the ideal suit for your house, then acquisitions anything with the dealer. The difference in between precisely what the wholesaler covered the documents and just what the client paid is real earnings.

However Dollar5,000 is not plenty of to order a building, that it is enough to get along an earnest revenue pay in. In the end, the objective of wholesale suppliers is always to certainly not in fact land in a contract on their own. To that end, most wholesale suppliers give a ailment for the contract that releases them as a result if this company is ineffective to find a last client.

7. Associate up

If there is a close friend who stock shares your real-estate tycoon objectives, then blending your investing helps you to go more than frequently person might on their own.

You will certainly need to work with a person with the exact same eyesight of achievements just like you. When you are thinking about a protracted-time period investment however they would like a speedy make use of, then you'll also the two be frustrated.

In the long run, who has never always wanted owning a lovable holiday getaway holiday cottage they are able to give associates? In will be with contributory advantages, a single person are prepared for the difficulties of being qualified renter's and bargaining rent payments although the other deals with the home.

Nevertheless it appears odd to formalize your relationship officially, many specialists consent that is the secret to keeping your dollars and your close friends.

8. Real estate investment opportunities trusts

Investor trusts, or REITS, can be like joining up, but a greater multilevel. REITs develop a small-danger expenditure but potentially have to demonstrate large earnings. Think about it like this: with Usd5,000, that can be done a good deal. Having a good friend who also offers dollars to get, that you can do even more. Having a significant multilevel of folks that are common investment? You will have the largest prospects for rewards.

Quite a few REITs are publicly owned, but you can also find non-public REITs.

You can now choose community REIT, but normally only accredited shareholders can purchase personal REITs.

To become a certified investor:

- You will need a earnings that’s higher than Usd200,000 during the last a couple of years. Or, if merging revenue that has a partner, make certain income greater than Buck300,000. - You'll want fabric truly worth greater than Buck2million dollars, individually or which has a spouse.

If you’re thinking if the household counts toward your net worth or financial debt, the solution may get more advanced.

You will discover variations in between how private and public REITs compensate which could make one a better option in your case compared to the other. One particular major variance is that individual REITs really don't calculate discuss charges normally.

Publicly owned REITs will be more water. Meaning accessible and selling your stocks quickly. In addition, it means that you need to have to a target market imbalances so that you can figure out when you ought to offer.

Confidential REITs convey more standards available and are generally a smaller amount liquefied. Even though non-public REITs have excessive come back cost, your decision of ought to offer is normally made in progress and is particularly just a few a good investment decision name. If each day stock market changes won't be anything you will observe oneself thoughtful about, then this individual REIT could be a better choice to suit your needs.

RealtyMogul is actually a real estate crowdfunding web site, additionally it offers personal REIT advantages to either experienced and newbie buyers. For not for-certified shareholders, RealtyMogul delivers its own personal REITs.

RealtyMogul’s REITs have a lot of flexibleness. Unlike standard investments, you happen to be only needed a financial commitment for the year. If after a twelve months it becomes clear that you wish a refund more than you intend to keep the gives you, you can sell rid of it for the business.

9. Housing crowdfunding

On the subject of massive real-estate investments, often it requires a village. Crowdfunding chances legitimate house purchases pool area investment strategies from a lot of people to finance various projects.

Every crowdfunding internet site is a touch distinctive. Even though this seems like a REIT, and there can be lots of crossover forwards and backwards concepts, crowdfunding websites provide you with a much more treatments for kinds of assignments you spend money on.

Fundrise was likely the primary crowdfunded value property party. In some ways, Fundrise functions like equally a technological company and a real estate company.

Certainly one of Fundrise’s distinct characteristics is actually a reduced profile minimal. With under Dollar500 you may get started off. That has a Money1,000 or higher financial commitment, Fundrise enables you to select a couple of Primary Prepare techniques. Supplemental Income pays off the very best rewards those of you that desire a return now, and Extended-Period Expansion gets the greatest whole give back. Balanced Committing hits an account balance backward and forward.

EquityMultiple’s claim they can reputation is how carefully it your vet initiatives. Lower than 10% from the projects listed in EquityMultiple are acknowledged.

A guarantee Numerous features their effective assignments with their web site. Some testimonials incorporate projects to make mature casing in Boston ma, condo rentals in Brooklyn, and workplace in Washington. You must be an approved individual to begin with with Money Several.

10. Look-to-professional lending

Even though Fundrise and EquityMultiple vet's and fund large initiatives, expert-to-expert lender wholesaling for dummies is ways to get people.

The benefit to this particular that you may occurs investment that will help somebody purchase their initially property or make considerably-required fixes. It's very easy to have purchased individuals' tales, and most peer-to-peer loaning permits you to be as palms-on as you would like. You are able to on their own choose projects that you confidence.

The velocity of give back and danger are directly related right here, however. If you wish to only account those who a favorable credit ranking and therefore are comparatively safe, you then should not have enormous results. If you want to find the riskiest credit circumstances, your likely incentive is bigger - but that is your chance. Like crowdfunding, these options are all a small amount diverse.

Peer Street

Fellow Neighborhood specially is targeted on crowdfunding for homebuyers. The majority of Expert Street’s investments pay off in just a couple of years. Expert Block is just open to approved buyers, in case capable, you only will need Bucks1,000 to get started.

Fellow Streets is one of the more recent expert-to-peer loan merchants and described elevating Usd60 thousand in April 2019. That might mean additional chances for first time investors rapidly.

Credit Clb

Lending Golf club is certainly not limited by housing, but that’s one of the leading factors bank loan candidates travel to the internet site. Like Expert Neighborhood, you’ll have to have $1,000 for starters. Once you get began, while, it is possible to purchase any rise of Dollar25.

With Dollar5,000, there is an minimum expenditure wanted to join Credit Club’s PRIME services. This somewhat-computerized expenditure support lets you established guidelines for what lending products you are going to put money into. Then, your investments are going to be what is house wholesaling automated within just these pointers.

Grow

Like Credit Team, Prosper is required for various unsecured loans. Outside the look-to-professional loan companies, Grow requires the least initial investment. For Usd25, you can start picking out jobs on Flourish.

Not surprisingly, this is a case of very little went, nothing at all gained. A 10Per-cent charge of go back is incredible, but with Buck25, that still probably won't purchase that you flavored coffee. As soon as we've become started with Prosper, you can personal loan any amount you would like.

Committing to real estate investment is usually as simple as grabbing an app, however, for area investment guidance, ending up in a broker is a great 1st step. McGrath recommends speaking with the local broker and receiving an area financial expert you may speak to. These are among your best resources are the real deal est news flash and investment decision prospects in your local area.